Structure products

Client benefits include

• Selection of multiple investment tracks with varying risk levels based on client preferences.

• Investing in products that enable clients to profit even in a declining market.

• Capital Guarantee products that ensure the return of the invested principal (excluding management fees).

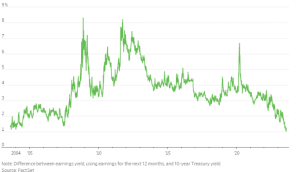

• Use of sophisticated criteria for selecting stocks and indices, including analysis of correlation, price, macroeconomic data, and risk management.

• Expertise in developing structured products with durations of one year or more.

• Enables clients to specify the desired level of risk and mechanisms for protecting their investment.

• Mitigating issuer risk by collaborating with esteemed institutions, including Julius Baer, a leading Swiss private bank.

The incorporation of structured products into investment portfolios enables us to offer the potential of superior returns tailored to the investors desired risk profile.

• Investing in products that enable clients to profit even in a declining market.

• Capital Guarantee products that ensure the return of the invested principal (excluding management fees).

• Use of sophisticated criteria for selecting stocks and indices, including analysis of correlation, price, macroeconomic data, and risk management.

• Expertise in developing structured products with durations of one year or more.

• Enables clients to specify the desired level of risk and mechanisms for protecting their investment.

• Mitigating issuer risk by collaborating with esteemed institutions, including Julius Baer, a leading Swiss private bank.

The incorporation of structured products into investment portfolios enables us to offer the potential of superior returns tailored to the investors desired risk profile.

Interested in learning more?

Please provide your details, and we will reach out to you promptly. Alternatively, you can reach us directly at *6278"*" indicates required fields