Clarity Wealth Managers

Since 2006, our investment management firm, based in Tel Aviv and New York, has specialized in wealth management, providing tailored capital and investment management services to private and institutional investors worldwide, including individuals, families, funds, estates, and institutions.

Our services

Expert professional investment management can significantly impact long-term wealth and profoundly influence family wealth structures for future generations. Clarity offers the following services:

Private Wealth Management (PWM)

Private Wealth Management (PWM) – we provide wealth management solutions for high-net-worth private clients, globally (large accounts of $3 million and above). We manage global investment portfolios in banks in Israel and in a selection of leading banks around the world, selected carefully according to our client’s needs.

Read MoreSC Premium

SC Premium offers global investment portfolio management for private clients with financial wealth of $500,000 and above

Read MoreAlternative Investments

Sigma Clarity Group's Clarity Wealth Managers is Israel’s premier firm operating in the alternative investments sector. Our seasoned team has been successfully navigating the complexities of private assets on behalf of our clients. With a proven track record of over 200 alternative investments and an annual vetting of 500 opportunities, Clarity's proprietary process ensures only the top 4% of opportunities are approved by our dedicated alternative investment committee.

Read MoreManagement of investment strategies

Let your investment portfolio break boundaries

Interested in managing a global investment portfolio?

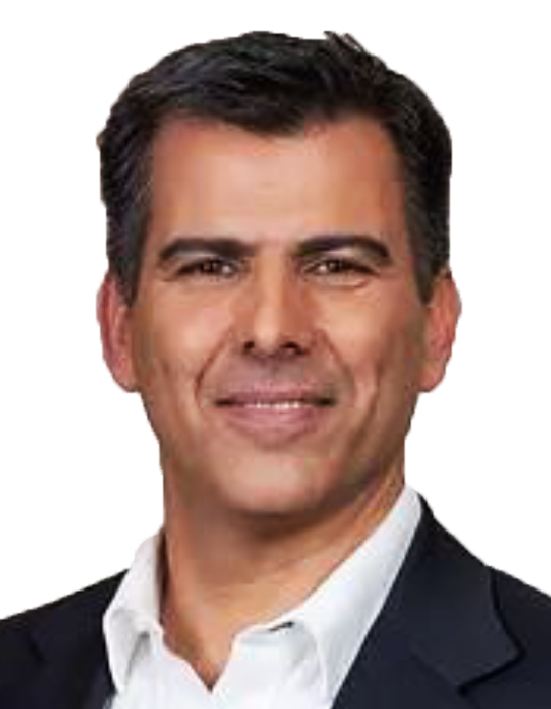

Yohan is the controlling owner of Sigma Clarity. He has over 25 years' experience in the financial market industry in Europe and Israel.

Prior to Joining Sigma Clarity, Yohan held a series of senior positions in the capital market. He served as the CEO of Psagot Investment house - one of the largest investment houses in Israel, Chairman of the board in More Magna AM, Executive Chairman of the Board of Meitav Dash Brokerage, and founder and Chairman of Camalia Capital Markets.

Yohan has a bachelor's degree in major of Finance in IFAM (institute franco Americana de management) France

Amir has extensive experience in investments and capital markets and has held a number of senior positions in these sectors. Among these, he served as chief strategist and COO of Clarity Capital, chief risk officer of Borderfree (E4X), and senior trader at Bank Hapoalim.

Chief Investment Officer (CIO) at Clarity Wealth Manager

35 years’ Capital Markets experience including 10 years in UBS and ABN AMRO London, as Credit and Equity Derivative Specialist and 2 Years in Societe Generale Computer Leasing Subsidiary in Tokyo

Co-Founder and CEO, Algosave Fintech Sponsored By Barclays, Natwest Bank and Funded By Techstars

MBA and MA, Accounting and Finance Nancy University (France)

Senior Client Relationship Manager, Clarity Wealth Management since 2013

Business Development Manager, Bank of Jerusalem, International Private Banking Branch Financial Advisor & Financial Advisor , Bank Leumi ,International Private Banking, Tel Aviv, Israel

Financial Advisor , Bank Leumi USA, Beverly Hills , CA

BA in Economics & International studies , Hollins University, Virginia, USA

Ruthy has been serving for over a decade as senior vice president and manager of the premium unit at Sigma Clarity Investment House.

Before that, Ruthy had a long career at Bank Hapoalim, in which she was, among other things, the head of the bank's Anglo desk and took care of private clients in the international division.

Also, Ruthy handled the international activities of some of the largest companies in Israel and of foreign embassies and managed the investments of top executive clients.

Ruthy has a bachelor's degree in economics and business administration.

Slava Solodkin brings over 20 years of experience in the financial markets, specializing in financial advisory and investment services for ultra-high-net-worth individuals (UHNWIs) and corporations. He currently serves as Senior Vice President and Senior Customer Relationship Manager at Sigma Clarity, where he is responsible for developing and managing strategic client relationships and leading the international investments and banking division.

Throughout his career, Slava has held senior positions at Bank Hapoalim, with his most recent role being Vice President, Senior Customer Relationship Manager in the International Division, where he managed a portfolio of high-net-worth clients from the Commonwealth of Independent States (CIS), specializing in business development and complex financial advisory. Additionally, he served as Deputy Manager in Private Banking within the Retail Division. Slava holds licenses in investment management and pension advisory, as well as a Bachelor's degree in Economics and Management, with honors.

Eli has extensive experience in controlling investment operations and implementing information systems, most of which he gained at Migdal Insurance.

In his previous positions he was involved in managing employees and processes in the field of investment control and regulation.

In his last position, he served as an internal auditor of the investment department at Migdal.